Anúncios

If you are looking for a credit card that offers attractive travel rewards, the Capital One Venture Rewards may be an excellent choice. In this detailed guide, we will explain step by step how to apply for this card, the requirements you need to meet, and the benefits it offers, based on the official information available on the Capital One website.

Capital One Venture Rewards Credit

Capital One – Step-by-Step Guide to Apply for the Venture Credit Card

Anúncios

Applying for the Capital One Venture Rewards Credit Card is simple if you follow this step-by-step guide. This tutorial will show you exactly how to access the site, select the right card, and complete your application.

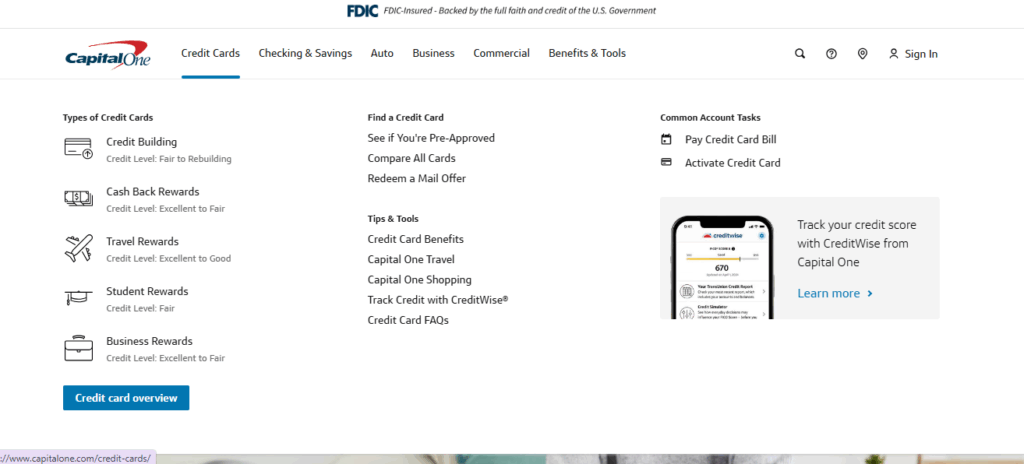

1. Access the Capital One Homepage

Visit the official Capital One website: https://www.capitalone.com/.

Once on the homepage:

- Click on the first menu option “Credit Cards”.

- Then select the third option “Travel Rewards”.

This page will take you to the main Travel and Miles Rewards section, where you can see all travel-focused credit card options.

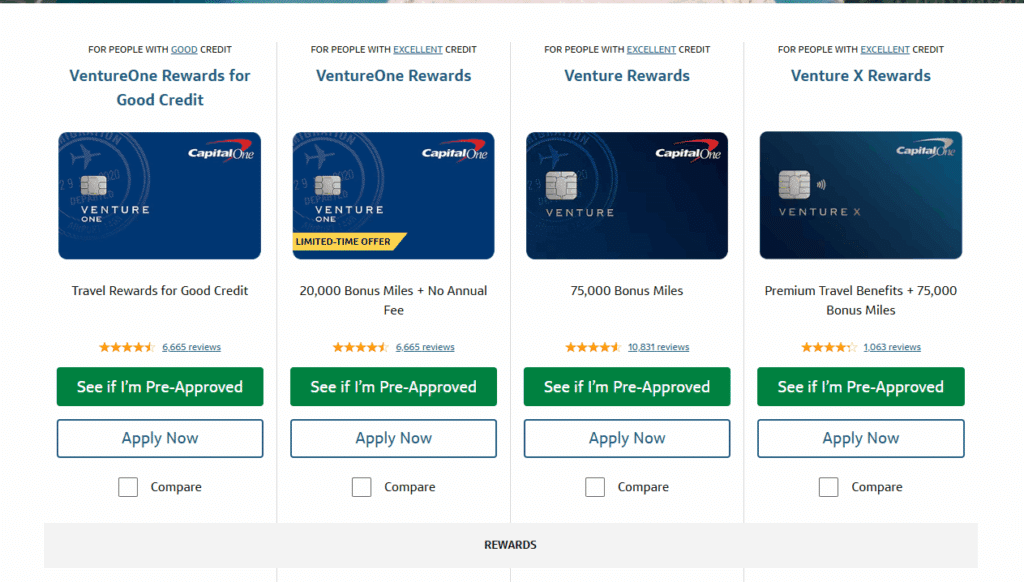

2. Select the Venture Rewards Card

Anúncios

On the Travel and Miles Rewards page, you will find multiple cards including:

- VentureOne

- VentureOne Rewards

- Venture X

- Venture Rewards

Choose the third card: “Venture Rewards” and click the “Apply Now” button.

This ensures you are applying for the correct card that offers 2X miles on all purchases and a generous welcome bonus.

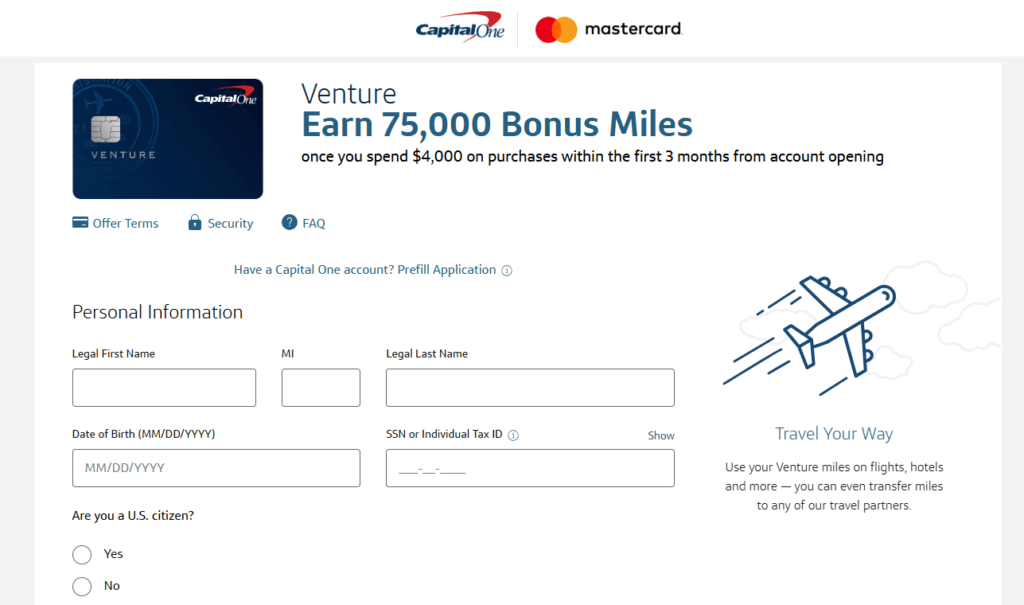

3. Complete Your Personal Information

Fill in your personal details in the application form, including:

- Full name

- Address

- Social Security Number (SSN)

- Annual income

- Employment information

After submitting, wait for Capital One to review your application. If approved, your Venture Rewards credit card will be sent to your registered address.

✅ Tips for a Smooth Application

- Ensure all information matches your credit report.

- Maintain a good credit score (usually 700+) to improve approval chances.

- Use a stable U.S. address and SSN.

- Check that you meet the income requirements to qualify.

Everything You Need to Know to Apply for the Capital One Venture Rewards Card

1. Accessing the Website and App

To start the application process, you can visit the official Capital One Venture Rewards website via this link: https://www.capitalone.com/credit-cards/venture/. On this site, you will find all detailed information about the card, including benefits, fees, and the button to start your application.

Additionally, Capital One offers a mobile app available on the App Store and Google Play. Through the app, you can manage your account, track your rewards, and make payments.

2. Basic Requirements for Application

To be eligible for the Capital One Venture Rewards card, you need to meet the following criteria:

- Credit Score: It is recommended to have an excellent credit history. While Capital One does not disclose a specific minimum score, a credit score above 700 is generally considered favorable for approval.

- Annual Income: You will need to provide information about your annual income during the application process. Although Capital One does not specify a minimum amount, a stable income sufficient to cover your expenses is essential.

- Social Security Number (SSN): As Capital One is a U.S. financial institution, you must have a valid SSN to apply for the card.

- U.S. Residency: You must be a U.S. resident to be eligible.

3. Approval Process

After submitting your application, Capital One will perform a credit review, considering your financial history, credit score, and other relevant factors. If approved, you will receive the card at your registered address. If your application is denied, Capital One will provide information on the reasons and suggestions to improve your eligibility in the future.

Overview of Capital One Bank

Capital One is one of the leading financial institutions in the United States, offering a wide range of products and services, including credit cards, bank accounts, and personal loans. Founded in 1994, the bank has stood out for its technological innovation and commitment to transparency and customer service.

Headquartered in McLean, Virginia, Capital One has a significant presence in the U.S. market and is recognized for responsible financial practices. The institution is a member of the FDIC (Federal Deposit Insurance Corporation), which ensures the safety of clients’ deposits.

Capital one Bank

FAQ – Frequently Asked Questions about the Capital One Venture Rewards Card

1. What are the benefits of the Capital One Venture Rewards?

- Travel Rewards: Earn 2 miles per dollar spent on all purchases and 5 miles per dollar on hotels, car rentals, and vacation rentals booked through Capital One Travel.

- Welcome Bonus: Receive 75,000 bonus miles if you spend $4,000 in the first 3 months after account opening.

- Annual Fee: The card has an annual fee of $95.

- Interest Rate: Variable APR ranges from 19.99% to 29.24%.

- No Foreign Transaction Fees: Ideal for international travel.

2. How can I use my accumulated miles?

The miles can be redeemed in several ways, including:

- Travel Bookings: Use your miles to book flights, hotels, and car rentals through Capital One Travel.

- Transfer to Loyalty Programs: Transfer your miles to partner airline loyalty programs.

- Cover Purchases: Use your miles to cover previous purchases such as trips or meals.

3. What if I do not meet the credit requirements?

If your credit score does not meet the recommended criteria, you can consider the following options:

- Credit Cards for Average Credit: Capital One offers cards such as the VentureOne Rewards for Good Credit, which has more flexible credit requirements.

- Improve Your Credit: Work on improving your credit score before applying again.

4. Can I apply for the card if I am not a U.S. citizen?

Yes, as long as you are a legal U.S. resident and have a valid SSN, you can apply for the card.

Conclusion

The Capital One Venture Rewards is an excellent choice for those looking to maximize their travel rewards. With attractive benefits such as extra miles on travel purchases and a generous welcome bonus, the card offers excellent value. By following the steps outlined in this guide, you will be well-prepared to apply for and make the most of the benefits of this card.

If you wish to compare the Capital One Venture Rewards with other available options, Capital One offers a credit card comparison tool on its website: https://www.capitalone.com/credit-cards/compare/.