Anúncios

Applying for a credit card in the U.S. can be a complex process if you don’t know where to start. This detailed guide will walk you step by step through everything you need to know about requesting the Bank of America® Premium Rewards® Credit Card. You’ll learn the eligibility requirements, the application process, what happens after approval, and tips to improve your chances. We’ll also cover an overview of Bank of America itself and answer frequently asked questions about this card.

Premium Rewards

USA – American Premium: Step-by-Step Tutorial on How to Apply for the Credit Card

Anúncios

Applying for the American Premium Credit Card in the United States can be simple if you follow the correct steps. This detailed guide shows exactly how to access the Bank of America website, navigate credit card options, fill out the form, and complete your application successfully.

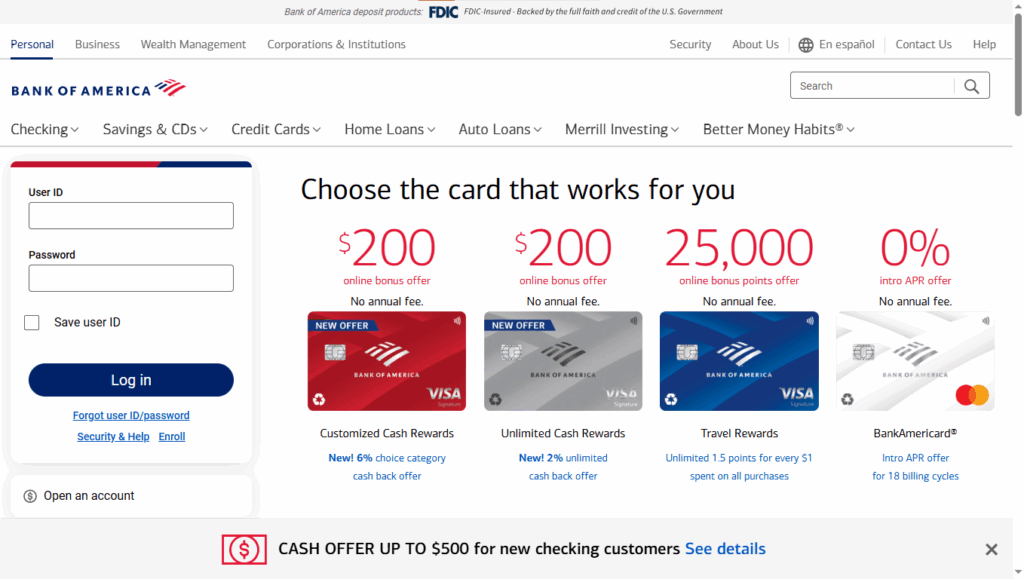

Step 1: Access the Bank of America Homepage

Open your browser and go to: https://www.bankofamerica.com/.

Here, you will have access to all the bank’s financial products, including accounts, investments, and credit cards.

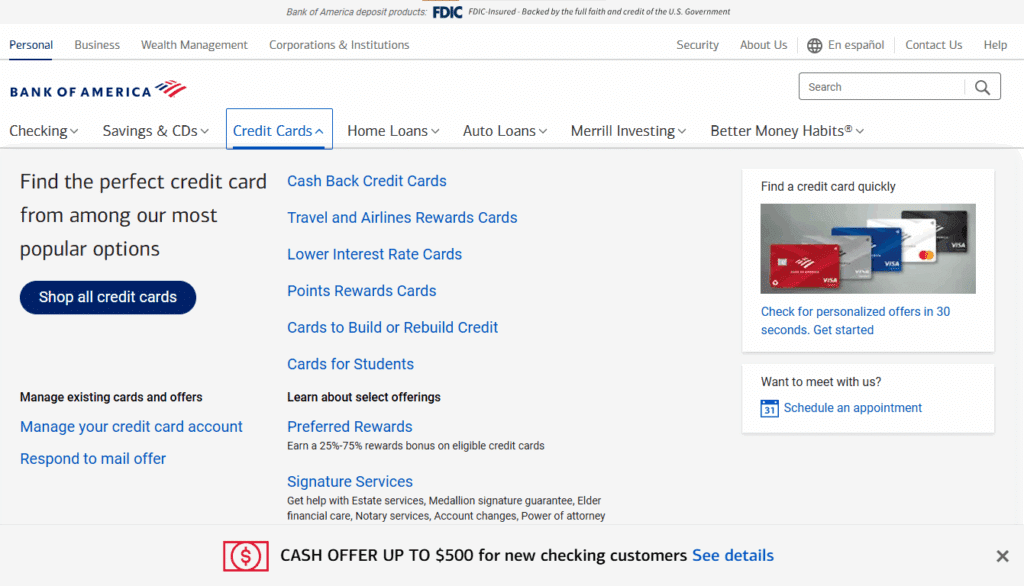

Step 2: Navigate to the Credit Cards Section

Anúncios

In the main menu, select the third option “Credit Cards”, then click the first option “Cash Back Credit Cards”.

This section displays all the Bank of America credit cards that offer cashback rewards.

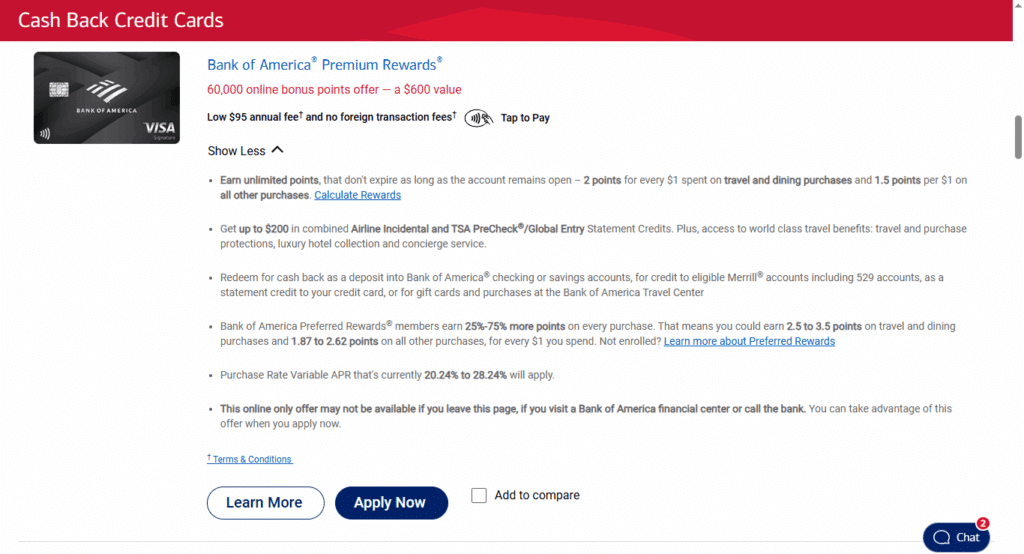

Step 3: Choose the Card and Click “Apply Now”

On the cashback credit cards page, you will find options such as:

- Bank of America® Unlimited Cash Rewards

- Bank of America® Customized Cash Rewards

- Bank of America® Customized Cash Rewards for Students

Click the blue “Apply Now” button for the card you want to apply for.

This button will start the application process for your selected card.

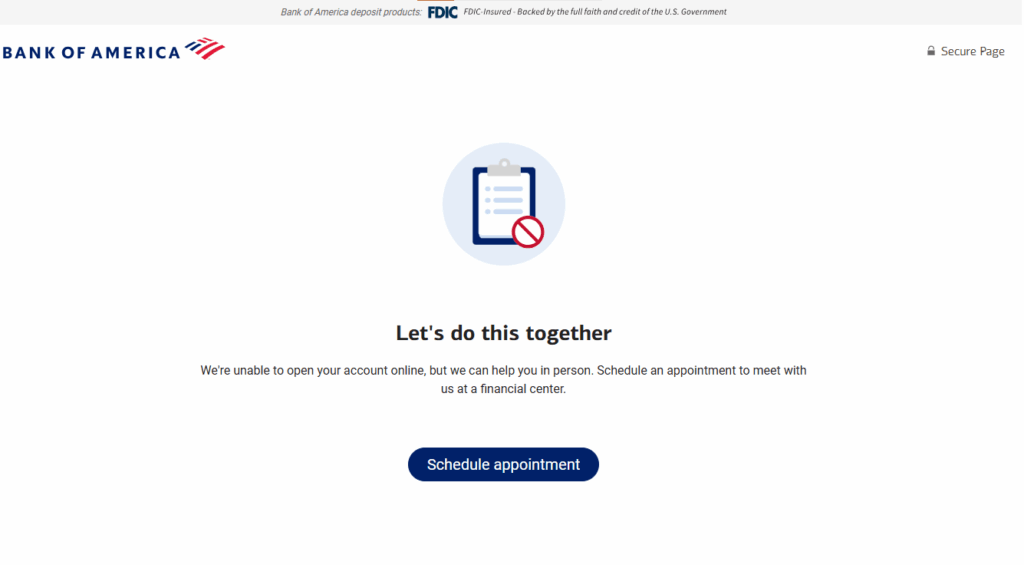

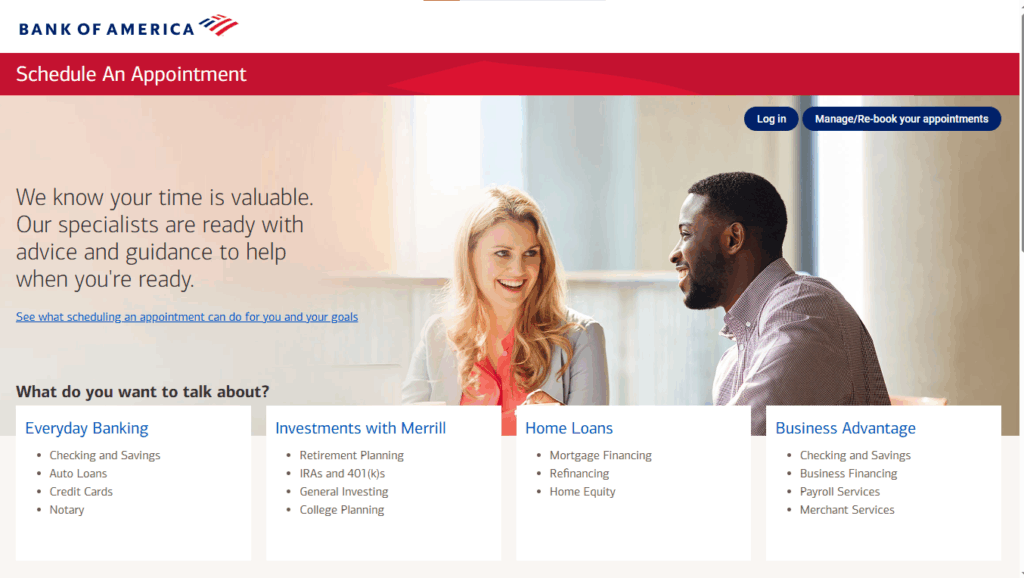

Step 4: Schedule Your Appointment

You will be redirected to the appointment scheduling page. Click the blue button “Schedule Appointment” to continue.

Scheduling is required for an initial review and personalized guidance on your credit card application.

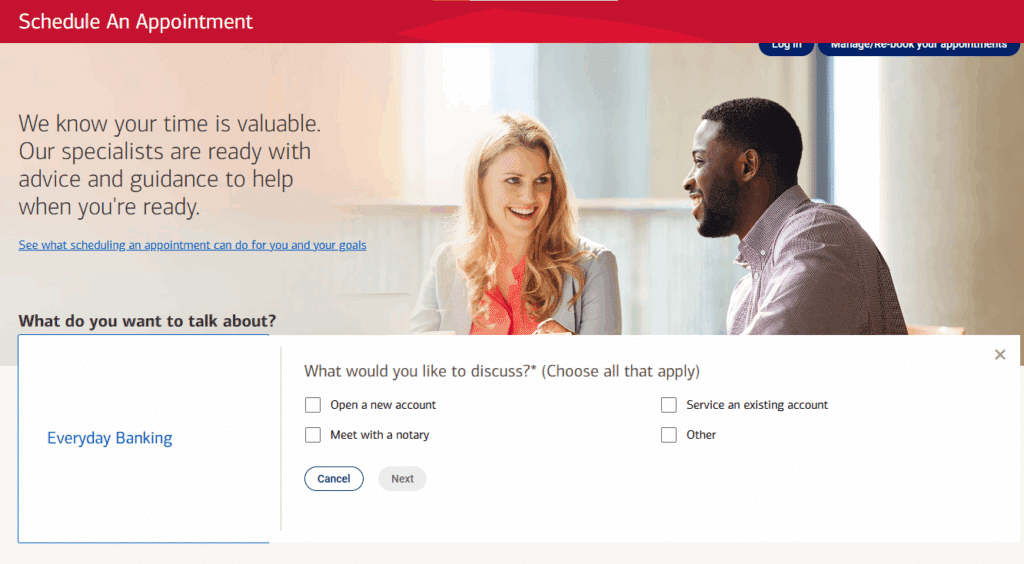

Step 5: Select “Everyday Banking”

On the next screen, click the first option “Everyday Banking”, which corresponds to the type of service related to the credit card.

This step ensures that your appointment is linked to the correct type of financial service.

Step 6: Fill Out the Form and Complete Your Application

Complete all the requested information in the scheduling form, including personal and contact details. Once submitted, your application will be processed, and you will receive your credit card shortly.

Tips for a Quick and Successful Application

- Have your SSN or ITIN and financial information ready.

- Make sure to fill in all fields correctly to avoid delays.

- Verify that your address and phone number are up to date.

- Track your application status via the Bank of America website or mobile app.

Everything You Need to Know Before Applying – Step-by-Step Guide

Why Choose the Premium Rewards Card?

The Bank of America® Premium Rewards® Credit Card is designed for people who want travel benefits, reward points, and premium perks. Some of its key highlights include:

- 2 points for every $1 spent on travel and dining purchases.

- 1.5 points for every $1 spent on all other purchases.

- No foreign transaction fees when using the card abroad.

- Up to $100 in airline incidental statement credits each year, which can be applied to baggage fees, lounge passes, seat upgrades, or other airline expenses.

- Up to $100 every four years for Global Entry or TSA PreCheck application fees.

- Points never expire as long as the account remains open and in good standing.

- Multiple redemption options: statement credit, direct deposit to Bank of America accounts, investment accounts, or travel portal redemptions.

- Travel protections, including trip delay insurance, baggage delay coverage, lost luggage reimbursement, and emergency assistance.

With an annual fee of $95, the card offers strong value if you frequently dine out, travel, or can take advantage of the annual travel credits.

Basic Eligibility Requirements

Before starting the application, make sure you meet the general eligibility criteria.

| Requirement | Details |

|---|---|

| Legal presence in the U.S. | You need a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). |

| U.S. residential address | A physical address in the United States is required for correspondence. |

| Income information | Applicants must provide annual income details from employment or other sources to demonstrate repayment ability. |

| Credit history | The Premium Rewards Card is designed for individuals with good to excellent credit scores. |

| Bank of America limits | Applicants may face internal limits on how many cards can be opened within certain timeframes. |

| Application frequency | Too many applications within a short period may result in denial. |

Note: Bank of America does not disclose exact minimum income or credit score requirements, as approvals depend on a full credit review.

Step-by-Step Application Process

Step 1: Prepare Your Information

Have these details ready:

- Full legal name, date of birth, and Social Security Number (SSN) or ITIN.

- U.S. address and phone number.

- Employment and income information (employer name, annual salary, additional sources of income).

- Monthly housing expenses such as rent or mortgage.

Step 2: Access the Official Bank of America Website or App

Visit the Bank of America website or mobile app, navigate to the Premium Rewards Credit Card page, and select “Apply Now” to begin your application.

Step 3: Complete the Application Form

You will need to provide:

- Personal information (SSN/ITIN, address, phone, date of birth).

- Employment and financial details.

- Consent for a credit check (hard inquiry).

Carefully review the terms and conditions, including interest rates, annual fee, and cardholder agreement.

Step 4: Submit the Application

Once submitted, you may receive an instant decision. Some applications require manual review, which can take a few business days.

Step 5: Monitor Your Application

You can track the status online through Bank of America’s application status tool or by contacting customer service.

Step 6: Approval and Card Delivery

If approved, the physical card will be mailed to your U.S. address. You’ll also receive a welcome packet with important details.

What Happens After Approval?

Once approved, you can:

- Activate your card online or through the mobile app.

- Set up automatic payments to avoid late fees.

- Maximize rewards by using the card for travel and dining.

- Claim the annual $100 airline incidental credit.

- Use the Global Entry/TSA PreCheck credit every four years.

- Track and redeem points through the Bank of America rewards portal.

Tips to Improve Your Chances of Approval

- Maintain a strong credit history by paying bills on time and keeping balances low.

- Avoid applying for multiple credit cards within a short time frame.

- Having an existing relationship with Bank of America, such as a checking or savings account, may strengthen your application.

- If denied, call the reconsideration line to provide additional documentation.

- Wait and reapply after improving your credit profile if needed.

Overview of Bank of America – Credibility and Presence in the U.S.

History and Scale

Bank of America is one of the largest financial institutions in the United States. It has millions of customers, thousands of physical branches across the country, and a leading presence in digital banking.

The bank is regulated by U.S. federal agencies, ensuring strict compliance with consumer protection and financial stability standards.

Bank of America

Products and Services

In addition to credit cards, Bank of America offers:

- Checking and savings accounts.

- Mortgages, auto loans, and personal loans.

- Investment services through Merrill.

- Small business and corporate banking solutions.

Security and Trust

- Accounts are FDIC insured.

- Fraud protection on all cards.

- Strong online security with multi-factor authentication and real-time transaction monitoring.

Preferred Rewards Program

Bank of America customers with qualifying balances can join the Preferred Rewards Program, which provides:

- Bonus rewards on credit cards (up to 75% more points).

- Discounts on loans.

- Free banking services.

This program significantly enhances the value of the Premium Rewards Card.

Frequently Asked Questions (FAQ)

1. What is the annual fee for the Premium Rewards Card?

The annual fee is $95.

2. Are there foreign transaction fees?

No. Purchases made abroad have no extra fees.

3. What travel credits does the card include?

- $100 annual airline incidental credit.

- $100 credit every four years for Global Entry or TSA PreCheck.

4. What is the reward rate?

- 2 points per $1 on travel and dining.

- 1.5 points per $1 on all other purchases.

5. Do points expire?

No, points never expire as long as your account remains open and active.

6. How can I redeem my points?

Points can be redeemed for statement credits, direct deposits, investment account credits, travel bookings, and gift cards.

7. Do I need to be a Bank of America customer to apply?

No, but existing customers may enjoy more benefits, especially through the Preferred Rewards Program.

8. What credit score do I need?

The card is typically geared toward applicants with good to excellent credit scores.

9. How long does approval take?

Many applicants receive an instant decision, while others may wait several business days.

10. What if my application is denied?

You can request reconsideration by calling customer service, providing additional information or documentation if needed.

Final Thoughts

The Bank of America® Premium Rewards® Credit Card is an excellent choice for individuals who travel frequently, dine out often, or want premium benefits with a reasonable annual fee. It combines generous rewards, annual travel credits, and strong protections, making it one of the top options in its category.

By following the step-by-step guide outlined above, ensuring you meet the eligibility requirements, and applying through the official Bank of America channels, you can maximize your chances of approval and start enjoying the rewards this card has to offer.