Anúncios

If you are looking for a credit card that offers consistent and straightforward rewards, the Citi Double Cash® Card is an excellent choice. This card provides unlimited 2% cashback: 1% when you make a purchase and 1% when you pay it off. Additionally, it offers a range of benefits that make it a popular choice among U.S. consumers.

Anúncios

In this detailed guide, we will cover:

- How to Apply for the Citi Double Cash® Card

- Overview of Citi Bank

- Frequently Asked Questions (FAQ)

Citi Double Cash

Step-by-Step Tutorial: How to Apply for the Citi Double Cash® Credit Card

Learn how to apply for the Citi Double Cash® Card quickly and easily, directly through the official Citi website. This guide is perfect for anyone looking to maximize cashback rewards without complications.

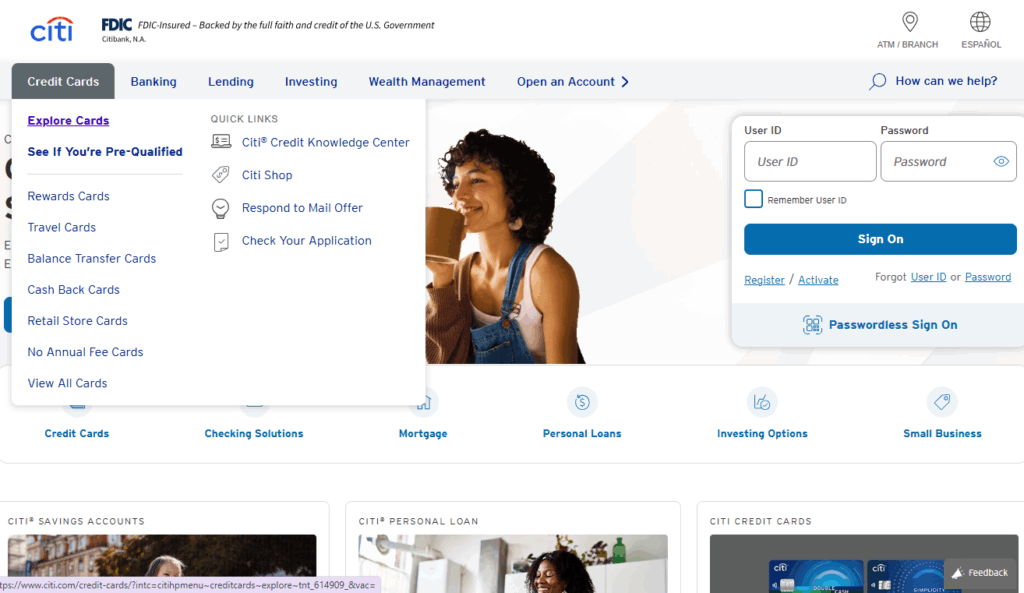

1. Access the Official Citi Website

First, go to the Citi homepage: https://www.citi.com/

In the main menu, select “Credit Cards” and then click “Explore Cards” to view all available card options.

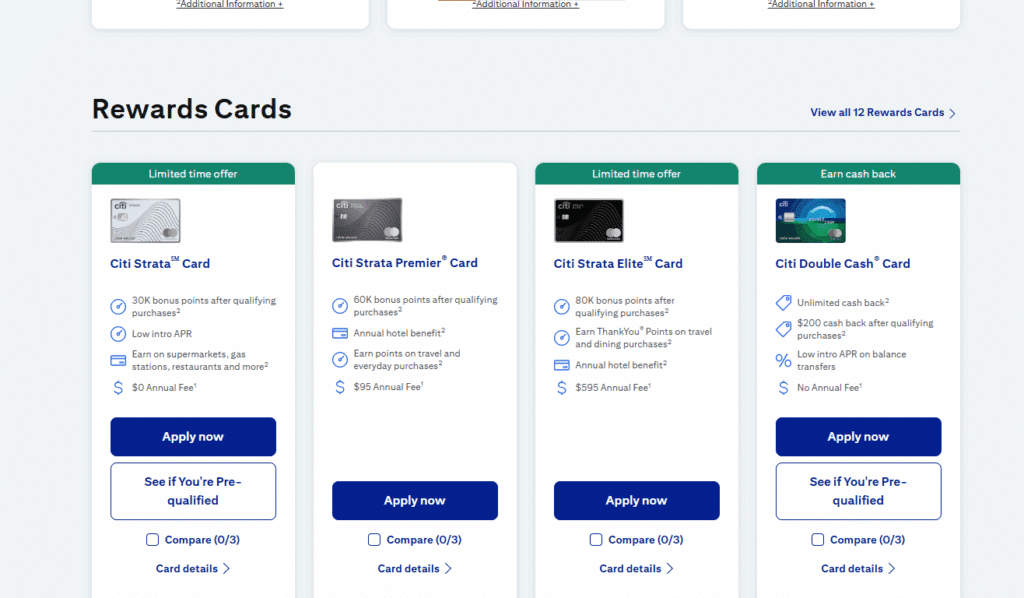

2. Browse the Available Cards

Anúncios

On the cards page, you will find several options, such as:

- Citi® Diamond Preferred® Credit Card

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- American Airlines AAdvantage® MileUp® Card

- Costco Anywhere Visa® Card by Citi

You can also filter cards by specific features:

Balance Transfer, Travel, Rewards, No Annual Fee, Cash Back, Retail.

To apply for the Citi Double Cash®, select the fourth option under “Rewards Cards”: “Citi Double Cash” and click the blue “Apply Now” button.

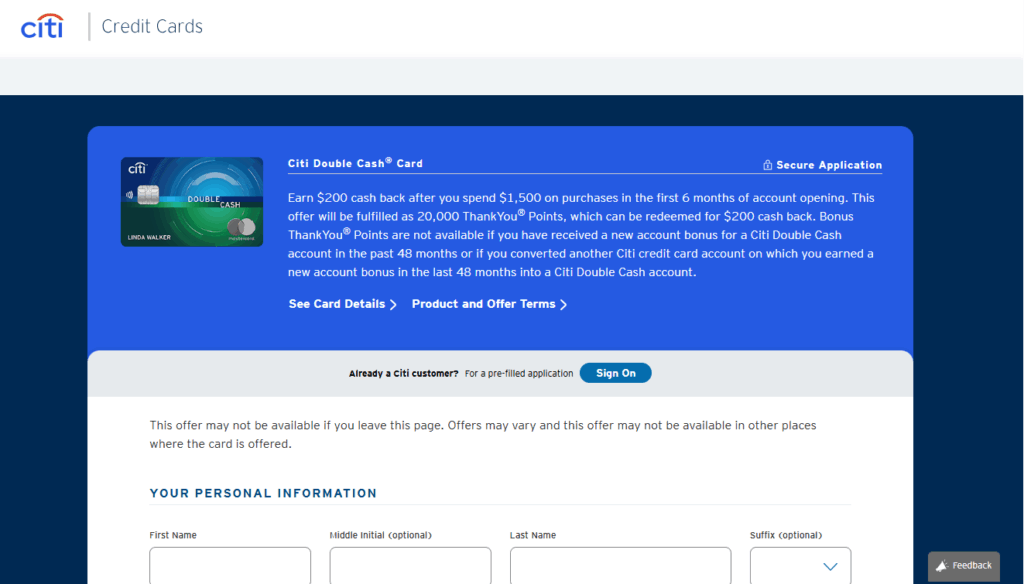

3. Complete the Application Form

After clicking “Apply Now,” fill out your personal information:

- Full name

- Residential address

- Phone number

- Financial information, if requested

Once you submit the form, your application will be processed, and you will soon receive your Citi Double Cash® Card.

1. How to Apply for the Citi Double Cash® Card

Step 1: Access the Official Website

To start the application process, visit the official Citi Double Cash® Card website:

👉 https://www.citi.com/credit-cards/citi-double-cash-credit-card

Click the “Apply Now” button to begin your application.

Step 2: Basic Requirements

Before filling out the application form, make sure you meet the following requirements:

- U.S. Residency: You must be a legal resident of the United States.

- Social Security Number (SSN): Required for identification and credit verification.

- Minimum Age: Applicants must be at least 18 years old.

- Credit History: While Citi does not specify a minimum credit score, a good credit history may increase your approval chances. (source)

Step 3: Filling Out the Application Form

The online application form will ask for the following information:

- Personal Information: Full name, address, date of birth, and phone number.

- Financial Information: Annual income, current occupation, and employer.

- Credit Information: Social Security Number (SSN) and credit history.

After completing all required fields, review your information carefully and submit your application.

Step 4: Tracking and Approval

After submission, you will typically receive a response within a minute.

- If approved, the card will be mailed to your registered address.

- If declined, Citi will provide information on the reason for the denial.

2. Overview of Citi Bank

History and Credibility

Citi, officially Citigroup Inc., is one of the largest financial conglomerates in the world, with a presence in over 100 countries. Founded in 1812, Citi provides a wide range of financial services, including credit cards, banking accounts, investments, and loans.

Citi Bank

Commitment to Innovation

Citi is recognized for its innovation in the financial sector, offering advanced digital solutions for its customers. The company was a pioneer in introducing EMV chip credit cards in the U.S. and continues to invest in technologies to enhance the customer experience.

Security and Protection

Customer security is a top priority for Citi. The bank provides 24/7 monitoring for suspicious activity, security alerts, and strict fraud protection policies.

3. Frequently Asked Questions (FAQ)

1. What are the benefits of the Citi Double Cash® Card?

- Unlimited Cashback: Earn 2% cashback on all purchases—1% when you buy and 1% when you pay.

- No Categories or Limits: No need to enroll in categories or worry about cashback caps.

- Sign-Up Bonus: Earn $200 cashback after spending $1,500 within the first 6 months.

- Travel Benefits: Earn 5% cashback on hotels, car rentals, and attractions booked through the Citi Travel portal.

- No Annual Fee: The card has no annual fee.

2. How can I redeem my rewards?

Rewards are accumulated as ThankYou® points and can be redeemed in various ways:

- Cashback: As a statement credit, direct deposit, or check.

- Travel: Book hotels, flights, and car rentals through Citi Travel.

- Shopping: Use points for purchases at participating partners, such as Amazon.com.

- Gift Cards: Redeem for gift cards from various stores and brands.

3. Is there an annual fee for the Citi Double Cash® Card?

No, the Citi Double Cash® Card does not have an annual fee. (source)

4. What happens if I don’t pay my balance in full?

If you do not pay your balance in full, the remaining balance will accrue interest. It is important to pay at least the minimum due to avoid additional fees and negative impacts on your credit.

5. Can I add the Citi Double Cash® Card to my digital wallet?

Yes, the Citi Double Cash® Card is compatible with digital wallets, allowing for quick and secure payments using mobile devices.

Conclusion

The Citi Double Cash® Card is an excellent choice for those seeking consistent and straightforward rewards. With a simple application process and attractive benefits, it stands out as one of the top credit card options in the United States.

To start your application, visit the official website: https://www.citi.com/credit-cards/citi-double-cash-credit-card