Anúncios

Applying for a credit card in the United States can feel like a complex process, especially if you are seeking a product that balances cash back rewards, flexibility, and no annual fee. The Chase Freedom Unlimited® is one of the most popular options on the market, combining generous rewards with the reputation of one of the largest banks in the country.

Anúncios

This article will walk you through a detailed, step-by-step tutorial on how to apply for the Chase Freedom Unlimited card, whether online or via the mobile app. You will also find an overview of Chase Bank—the issuer of the card—to better understand the credibility and stability behind this financial product.

By the end, you will have a complete understanding of how to prepare for the application, how to maximize your chances of approval, and why Chase is a trusted name in American banking.

Chase Freedom Unlimited

USA – Step-by-Step Tutorial on How to Apply for the Chase Freedom Unlimited® Credit Card

If you want to apply for the Chase Freedom Unlimited® in the United States, follow this step-by-step guide. This tutorial is easy to follow, clear showing how to access the Chase website, navigate the credit cards, and complete the application form correctly.

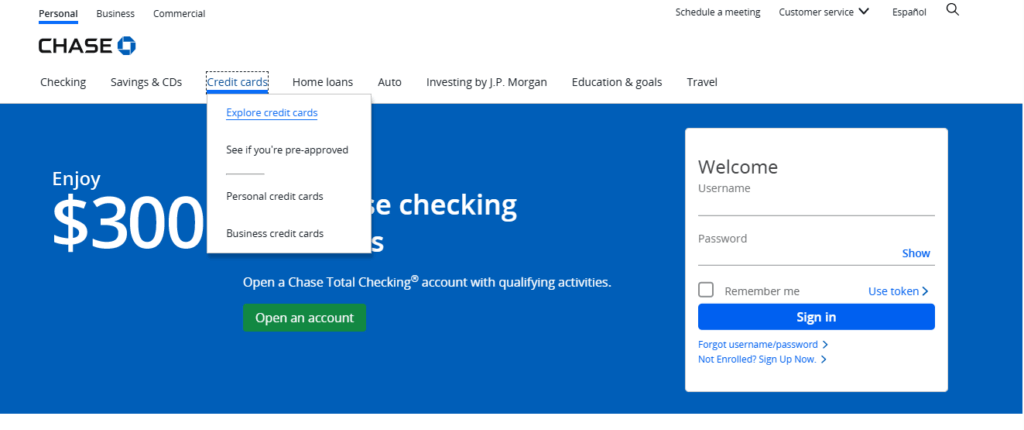

Step 1: Access the Chase Homepage

Anúncios

First, open the Chase Bank homepage. In the main menu:

- Click on the third option, “Credit Cards.”

- Then select the first option, “Explore Credit Cards,” to see all available credit cards.

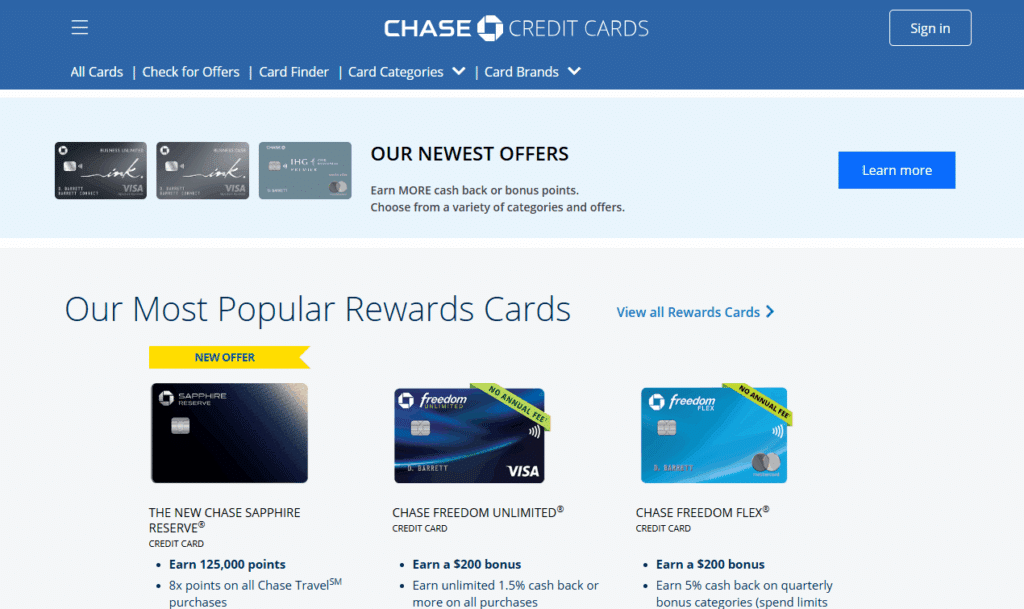

Step 2: Explore Available Credit Cards

On the next page, you’ll find detailed information about various Chase cards, including:

- Chase Freedom Flex®

- The New Chase Sapphire Reserve

- Chase Sapphire Preferred

- IHG One Rewards Premier

- The New UnitedSM Explorer

- And more

This page helps you compare benefits, fees, and rewards before choosing the right card for you.

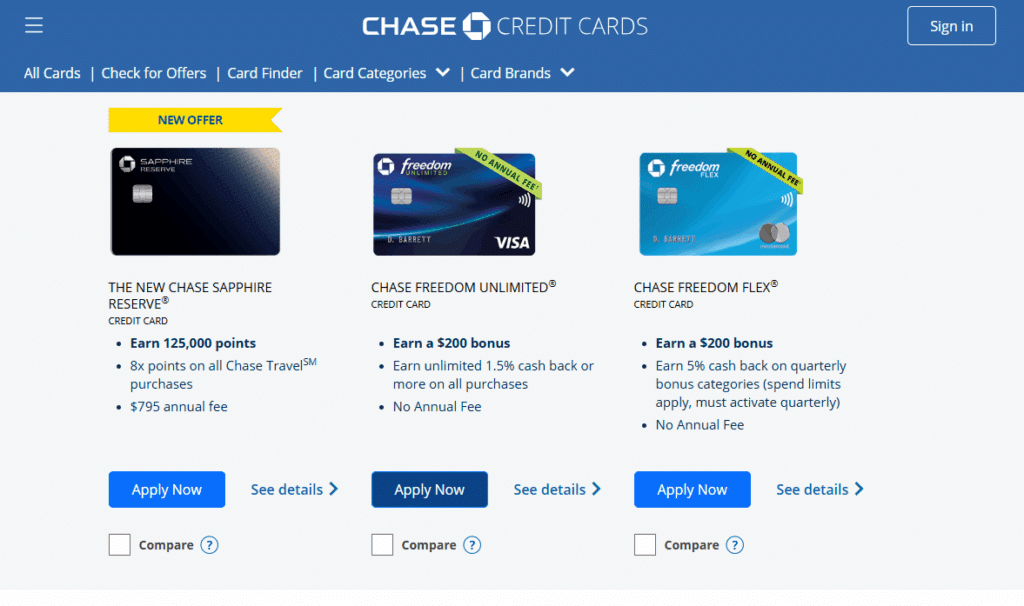

Step 3: Select the Chase Freedom Unlimited®

Look for Chase Freedom Unlimited®, usually appearing as the second option in the list.

- Click on the card to see more details.

- Then click the blue “Apply Now” button to start your application.

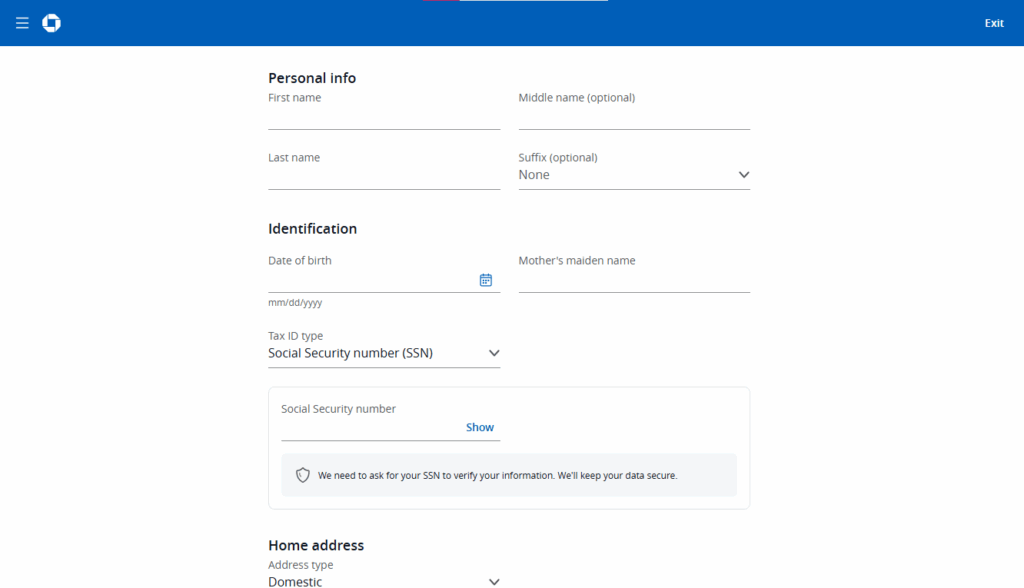

Step 4: Fill Out the Application Form

You will be redirected to the application form. Here, you need to provide:

- Personal information (full name, date of birth)

- Identification details (Social Security Number or ITIN)

- Residential and mailing address

- Contact information (phone and email)

- Income and employment details

Once you have filled out all the fields correctly, submit the form and wait for approval of your Chase Freedom Unlimited® card.

How to Apply for the Chase Freedom Unlimited Credit Card

The application process for the Chase Freedom Unlimited is designed to be straightforward, but preparation is essential. Here’s everything you need to know.

Step 1: Understand the Basic Requirements

Before beginning the application, make sure you meet the basic eligibility criteria. Applicants must:

- Be at least 18 years old (or the legal minimum age in your state of residence).

- Have a valid U.S. Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

- Provide a valid U.S. residential address and mailing address.

- Have a source of income to demonstrate repayment ability.

- Possess a credit history that meets Chase’s approval standards, usually requiring a good to excellent credit score.

Gather essential documents in advance, such as proof of income, employment details, and personal identification. Having these ready will speed up the process.

Step 2: Access the Official Chase Website or Mobile App

There are two main ways to apply: through the Chase website or the Chase Mobile App.

- Website Application

- Visit the Chase homepage.

- Navigate to the Credit Cards section and select Chase Freedom Unlimited®.

- Click on “Apply Now” to begin the online form.

- Mobile App Application

- Download and install the Chase Mobile App from your app store.

- Log in with your existing Chase account or create one.

- Select Credit Cards, then choose Freedom Unlimited.

- Tap Apply to start the mobile application process.

Both methods lead to the same application system and approval process.

Step 3: Fill Out the Application Form

The online form requires detailed information, including:

- Full legal name and date of birth

- Social Security Number (SSN) or ITIN

- Residential address and length of residence

- Phone number and email address

- Employment status and employer details

- Total annual income or household income

- Housing situation (rent, own, or other)

Applicants also have the option to request a balance transfer from another card at this stage if desired.

Take time to ensure all information is accurate. Mistakes or missing details may delay the approval process.

Step 4: Review Terms and Conditions

Before submitting, carefully review the pricing and terms of the card. These include:

- Introductory APR period (often 0% for the first 15 months on purchases and balance transfers)

- Variable APR after the introductory period

- Transaction fees, balance transfer fees, and late payment fees

- Rewards program details, including cash back rates and eligible categories

Reading the terms ensures you understand all financial responsibilities and avoid unexpected costs.

Step 5: Submit the Application

Once you have completed and reviewed the form:

- Click Submit to send your application.

- Many applicants receive an instant decision within seconds.

- In some cases, Chase may require additional review or documentation.

If approved, you will be informed of your credit limit and account terms. If denied, you may receive a letter explaining the reason.

Step 6: Track Application Status

You can track the progress of your application:

- Online through your Chase account.

- Via the mobile app.

- Through notifications sent by Chase by email or mail.

If Chase requests further information, respond promptly to avoid delays.

Step 7: Card Delivery, Activation, and First Use

Approved applicants will receive the physical card by mail within several business days. To activate:

- Call the activation number provided.

- Log in to your Chase account and follow the activation steps online.

- Or activate directly through the Chase Mobile App.

Once activated, sign the back of the card (if applicable) and begin using it for everyday purchases.

Step 8: Manage Your Card and Rewards

The Chase Freedom Unlimited offers multiple benefits:

- 1.5% cash back on all purchases.

- 3% cash back on dining and drugstore purchases.

- 5% cash back on travel booked through Chase Travel.

Rewards never expire as long as your account remains open.

Cardholders can redeem cash back as:

- Statement credits

- Direct deposit into a bank account

- Travel purchases through Chase Travel

- Gift cards and other redemption options

Managing rewards and monitoring spending is simple through the Chase Mobile App or online banking.

Tips to Increase Your Chances of Approval

- Maintain a good credit score: Pay bills on time and keep your credit utilization low.

- Avoid multiple recent credit applications, which can negatively impact approval odds.

- Check pre-approval offers on Chase’s website to see if you qualify without impacting your credit score.

- Provide consistent and accurate information throughout the application.

- Consider starting with Chase Freedom Rise if you are new to credit, as it helps build history before upgrading to Freedom Unlimited.

Overview of Chase Bank

Chase Bank

To fully understand the Chase Freedom Unlimited, it is important to know the institution behind it: Chase Bank, a division of JPMorgan Chase & Co.

A Brief History

Chase Bank traces its origins back to 1799, making it one of the oldest continuously operating financial institutions in the United States. Over the centuries, it has merged with several other major banks, including the historic J.P. Morgan & Co., creating what is now JPMorgan Chase & Co.

Today, Chase is a global leader in banking and financial services, consistently ranked among the top banks in the United States and worldwide.

Areas of Operation

Chase operates across multiple sectors:

- Consumer and Community Banking: Checking accounts, savings accounts, credit cards, personal loans, and mortgages for individuals and families.

- Commercial Banking: Financial services for small businesses and corporations.

- Corporate and Investment Banking: Capital markets, mergers and acquisitions, and global investment solutions.

- Asset and Wealth Management: Investment and advisory services for individuals, institutions, and high-net-worth clients.

Chase serves millions of customers through thousands of branches, ATMs, and a highly developed digital platform.

Credibility and Security

Chase Bank is known for its stability and credibility:

- It is a member of the Federal Deposit Insurance Corporation (FDIC).

- It offers 24/7 fraud monitoring and protection for cardholders.

- It invests heavily in digital security, protecting customer accounts against unauthorized transactions.

- Its scale and reputation provide reassurance to consumers seeking reliable financial products.

Position of the Chase Freedom Unlimited Within Chase’s Portfolio

The Freedom Unlimited belongs to Chase’s Freedom family of credit cards, which also includes Freedom Flex and Freedom Rise. These cards are designed for customers who value cash back rewards without annual fees.

The Freedom Unlimited is often considered a versatile “everyday card” due to its flat 1.5% cash back on all purchases, while also rewarding specific categories like dining, drugstores, and travel.

It complements Chase’s more premium cards, such as the Chase Sapphire Preferred® and Chase Sapphire Reserve®, which target frequent travelers and high spenders.

Conclusion: Why Apply for the Chase Freedom Unlimited?

The Chase Freedom Unlimited® combines simplicity, flexibility, and value. With no annual fee, competitive cash back rewards, and the backing of one of the most reputable banks in the United States, it is an attractive option for anyone looking to maximize their spending.

By following the step-by-step guide outlined in this article—preparing documents, applying online or through the app, and activating your card—you can confidently navigate the process and enjoy the benefits.

For individuals building credit, managing expenses, or simply seeking more value from everyday purchases, the Chase Freedom Unlimited is one of the most reliable and rewarding choices available in the U.S. credit card market.