Anúncios

If you are looking for exclusivity, luxury travel, and premium benefits in the United States Platinum credit card market, the American Express Platinum Card is, without a doubt, one of the most coveted. This prestigious card is a passport to a world of unparalleled advantages, from global airport lounge access to credits for entertainment and travel services.

Anúncios

This detailed guide, optimized for search terms like “how to apply for American Express Platinum credit cards in the United States” and “Platinum credit card United States,” will uncover the application process, requirements, and an overview of the institution behind this financial icon.

American Express Platinum Card

STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE PLATINUM CARD IN THE UNITED STATES

Applying for the American Express Platinum Card is simple and fast. Follow this complete guide to ensure you apply correctly.

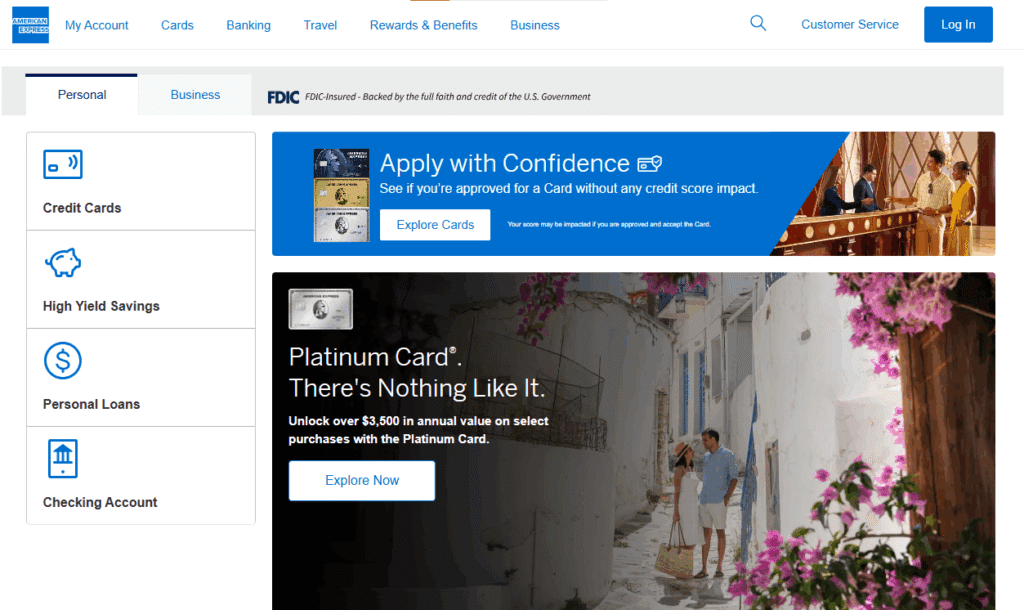

1. Access the American Express homepage

Visit the official website: https://www.americanexpress.com/ and click on the first icon in the “Credit Cards” column, located on the left side of the page.

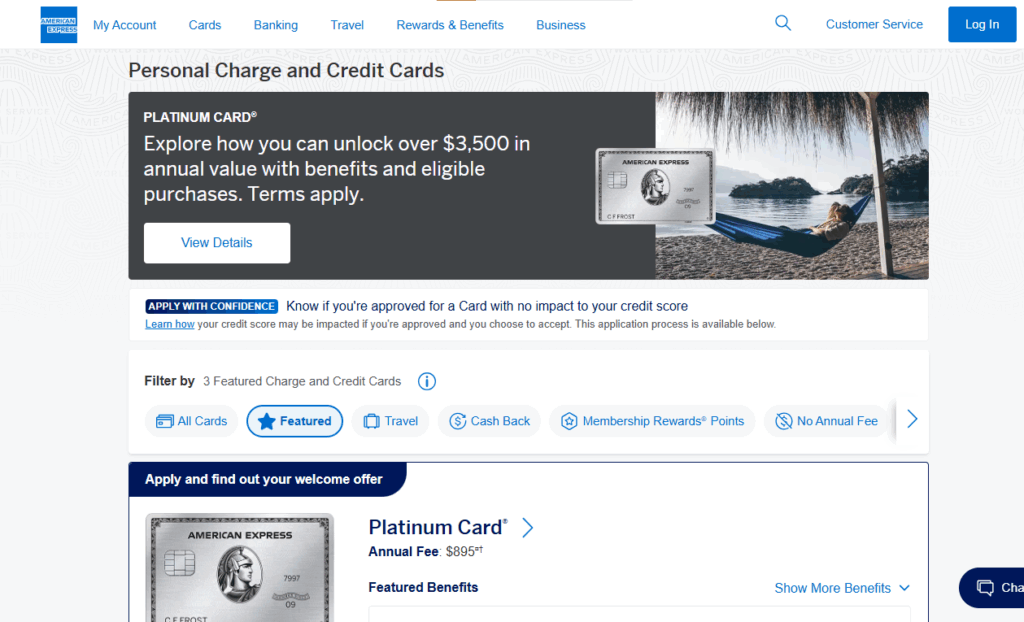

2. Select the Platinum Card

Anúncios

On the credit cards page, you will find several options, such as Gold Card, Blue Cash Preferred, and Blue Cash Everyday. Select the first option, which is the Platinum Card.

3. Review the card information

You will be directed to a detailed page with all the information about the Platinum Card: benefits, annual fee, rewards program, and exclusive perks.

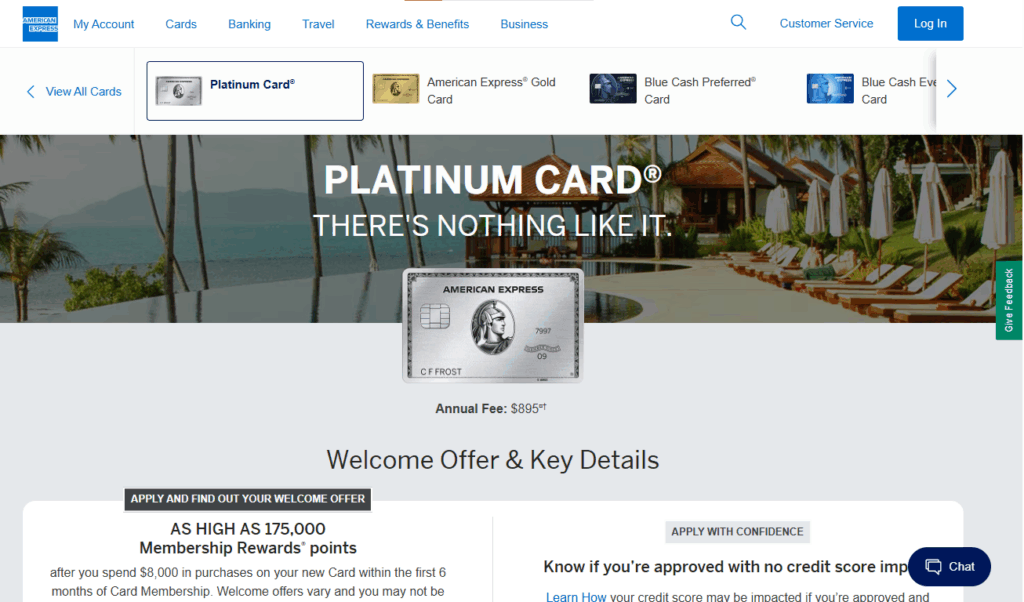

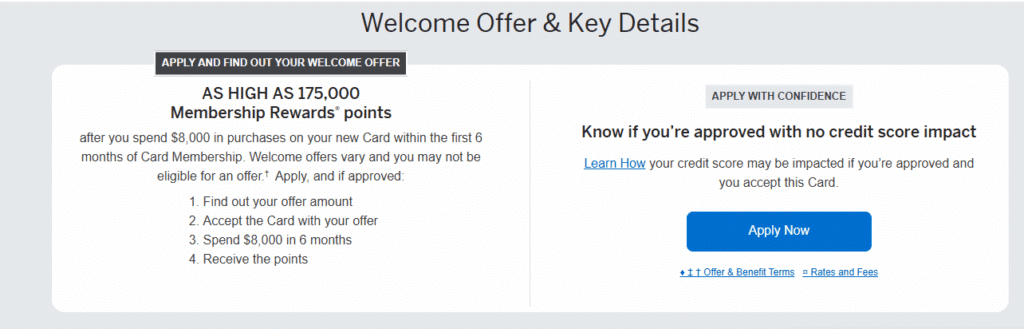

4. Click “Apply Now”

To start your application, click the blue “Apply Now” button, usually highlighted on the card page.

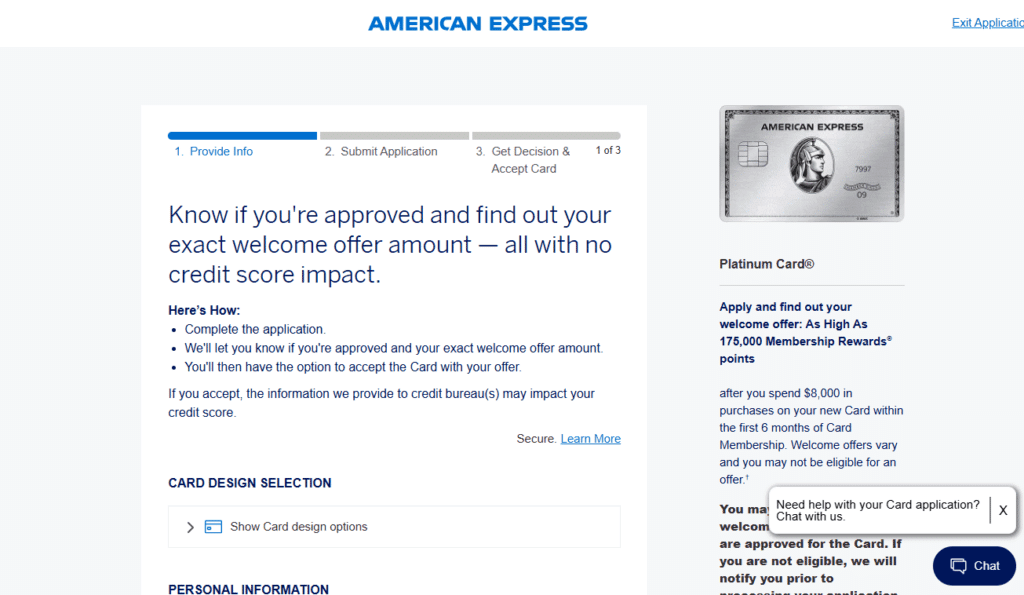

5. Complete the application form in 3 steps

You will be redirected to the application form, divided into three steps:

- Provide Info – Enter your personal information, address, income, and financial details.

- Submit Application – Review and submit your application.

- Get Decision & Accept Card – Wait for the bank’s decision and accept the card if approved.

✅ Conclusion

By following this step-by-step guide, you can apply for the American Express Platinum Card in the U.S. easily and securely, enjoying all the exclusive benefits of this premium card.

Step-by-Step Tutorial: Applying for the American Express Platinum Card

The process of applying for the American Express Platinum Card is conducted simply and securely, primarily through the online platform. It is essential that, when following this guide, you access the official American Express website in the United States to ensure the safety and accuracy of the information: https://www.americanexpress.com/us/credit-cards/card/platinum/.

1. Accessing the Official Product Page

The first step is to navigate to the dedicated Platinum Card page on the American Express website.

- Access via Browser: Type the URL directly:

americanexpress.com/us/credit-cards/card/platinum/. - Access via App: While the Amex app is essential for managing the card after approval, the initial application is usually more straightforward on the website. If using the app, look for the “Cards” or “Apply for a Card” section.

Once on the page, look for the prominent button that usually says “Apply Now” or similar.

2. Reviewing Basic Requirements and Eligibility

Before starting the form, understanding the requirements is crucial. The American Express Platinum Card is a premium product, and approval is based on a rigorous set of criteria, although Amex does not publicly disclose a guaranteed minimum credit score (FICO Score) for approval.

Key Requirements for Application:

- Residency Status and Age:

- Be a U.S. resident (citizen, permanent resident, or a visa holder whose status permits opening financial accounts, subject to Amex policy).

- Be 18 years old or older (or the age of majority in your state).

- Credit History:

- An excellent credit history is expected. While Amex doesn’t set a number, historically, cards of this caliber are approved for individuals with credit scores ranging from 700 to 850 (FICO/VantageScore), with scores in the 740+ range being safer.

- A history of timely payments and a low credit utilization ratio are essential.

- Income:

- There is no publicly defined minimum income requirement by Amex for the Platinum Card, but approved applicants typically demonstrate a substantial annual income that justifies the benefits and the high annual fee of the card.

3. Completing the Online Application Form

The form is divided into sections to collect your personal, financial, and contact information. Be precise and avoid errors, as discrepancies can delay or lead to the denial of your American Express Platinum credit card application in the United States.

Typical Form Stages:

| Category | Information Requested |

| Personal Information | Full Name, Date of Birth, Social Security Number (SSN) or, in some limited cases, an Individual Taxpayer Identification Number (ITIN). |

| Contact Information | U.S. Residential Address, Phone Number, Email Address. |

| Financial Information | Total Annual Income (including all sources), Source of Income (Salary, Investments, etc.). |

| Employment Information | Employment Status (Employed, Self-Employed, Retired, etc.). |

| Security | Creating a password and User ID (if you are a new Amex customer). |

- Important: Amex may ask if you are a current customer. If so, the process might be slightly faster, as the company already has part of your history.

4. Review and Submission of the Application

Before finalizing:

- Review: Check every field to ensure all information is correct and up-to-date.

- Terms and Conditions: Carefully read the Terms and Conditions (T&C), the Cardmember Agreement, and, crucially, the information regarding the Annual Fee ($695 at the time of writing, but always check the official site as it may change), Annual Percentage Rate (APR), and the interest charging policy.

- Authorization: By clicking “Submit,” you authorize American Express to perform a credit inquiry (a Hard Pull), which may temporarily affect your credit score.

5. The Approval Process

After submission, American Express may respond in three main ways:

- Immediate Approval: If you clearly meet all the criteria and the system detects no anomalies, you may receive instant approval on the screen.

- Pending Decision: Amex may need more time to review your application. They might contact you by email, phone, or mail to request additional documents (such as proof of income or identity) to verify your information.

- Denial: If the application is denied, Amex is required to send a written notice (Adverse Action Notice) detailing the reasons for the denial (e.g., low credit score, high debt, or insufficient history).

Overview of American Express Bank

American Express

For those seeking the Platinum credit card in the United States, it is essential to understand the institution offering it. American Express (Amex) is not just a card issuer; it is a global financial services giant with a history dating back to 1850.

Credibility and Operations in the United States

The American Express Company, headquartered in New York, is one of the most respected and recognized financial brands worldwide.

- Institutional Nature: Unlike many issuers who use networks like Visa or Mastercard, Amex operates its own payment network. This means Amex acts as both the issuer of the card and the processor of the transactions (a “Closed-Loop Network”).

- Focus on the Premium Consumer: Amex’s reputation has been built on exceptional service and benefits, especially for high-net-worth individuals and frequent travelers. The cards are synonymous with status and access.

- Global Operations: Although you are applying for the Platinum credit card United States, the brand’s acceptance and its network of lounges (like the renowned Centurion Lounges) and partnerships extend globally, consolidating its operation as a truly worldwide financial services company.

- Hybrid Products (Charge Cards): The Platinum Card is, technically, a Charge Card, although it is often referred to as a credit card. The main characteristic of a Charge Card is that the full balance must be paid each month. Although Amex has added the “Pay Over Time” feature to the Platinum, allowing qualifying balances to be carried over with interest, its core essence is different from traditional credit cards with spending limits and minimum monthly payments (though Amex also offers traditional credit cards).

Commitment to Customer and Innovation

American Express’s credibility is reinforced by its commitment to security and customer service. The company is frequently rated as one of the best in customer satisfaction in the credit card industry, offering:

- Fraud Protection: Highly sophisticated fraud monitoring systems.

- Concierge Service: For Platinum Cardmembers, the 24-hour Concierge service can assist with travel bookings, restaurants, and event tickets.

- Digital Innovation: The Amex mobile app is market-leading, allowing users to manage rewards, track expenses, and utilize card credits efficiently.

The robustness of Amex as an institution makes the Platinum credit card United States not just a financial product, but a symbol of reliability and excellence in premium services.